2025 Schedule A 2025 Itemized Deductions

2025 Schedule A 2025 Itemized Deductions – For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . For tax year 2025 (tax returns due April 2025), the standard deduction To claim your itemized deductions, you need to complete Schedule A, Itemized Deductions, of the Form 1040. That total is .

2025 Schedule A 2025 Itemized Deductions

Source : www.forbes.comTax for Business | Blog Post Categories | PriorTax.com

Source : www.blog.priortax.comKick Start Your Tax Planning For 2025

Source : www.benefitandfinancial.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

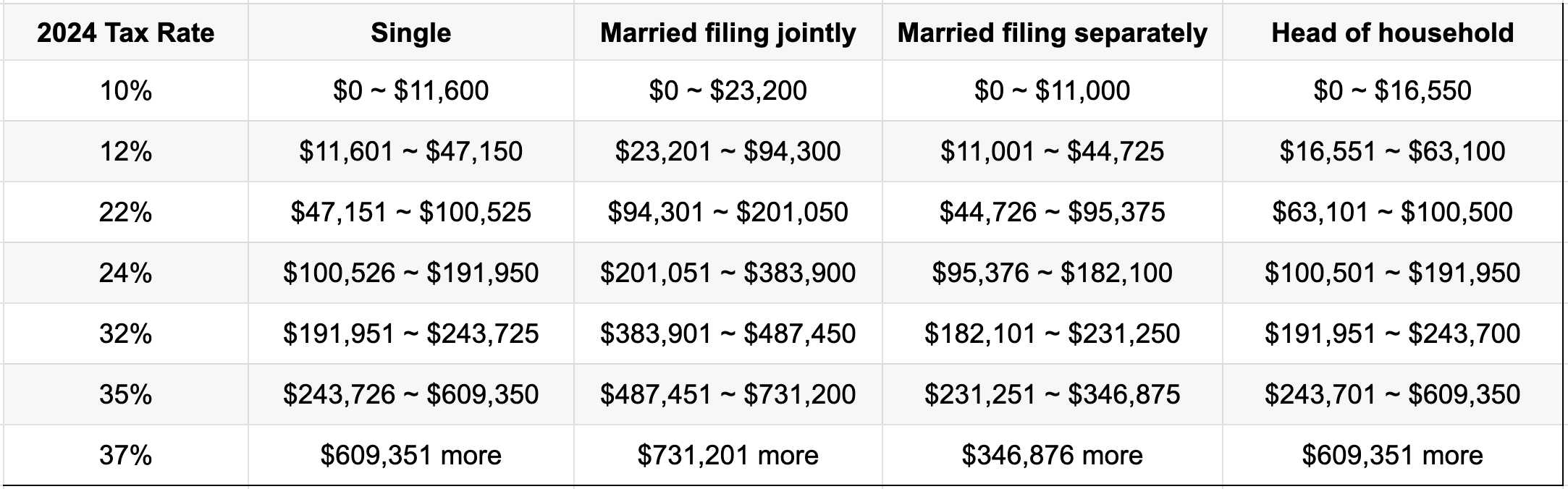

Source : www.investopedia.comIRS: Here are the new income tax brackets for 2025

Source : www.cnbc.comFree Tax Calculators & Money Saving Tools 2023 2025 | TurboTax

Source : turbotax.intuit.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comIRS Announces 2025 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.com2025 Schedule A 2025 Itemized Deductions IRS Announces 2025 Tax Brackets, Standard Deductions And Other : An overwhelming majority of American taxpayers—about 90%—claim the standard deduction on their federal income tax return. And, for most of those people, the standard deduction is the largest tax . Each year, the IRS adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax provisions. This article highlights the key charitable figures for 2025. .

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)